BUDGET WORKBOOK HEALTHCARE SOFTWARE

His employer covered most of the cost of the texts and school supplies but not the laptop or home PC he bought, which he also uses in his home business, and keeps a career library on and other professional software (which is deductible above what was reimbursed by the employer). Her husband, though working and helping her run the small business, went back to school, and will need to start paying back an educational loan this year.

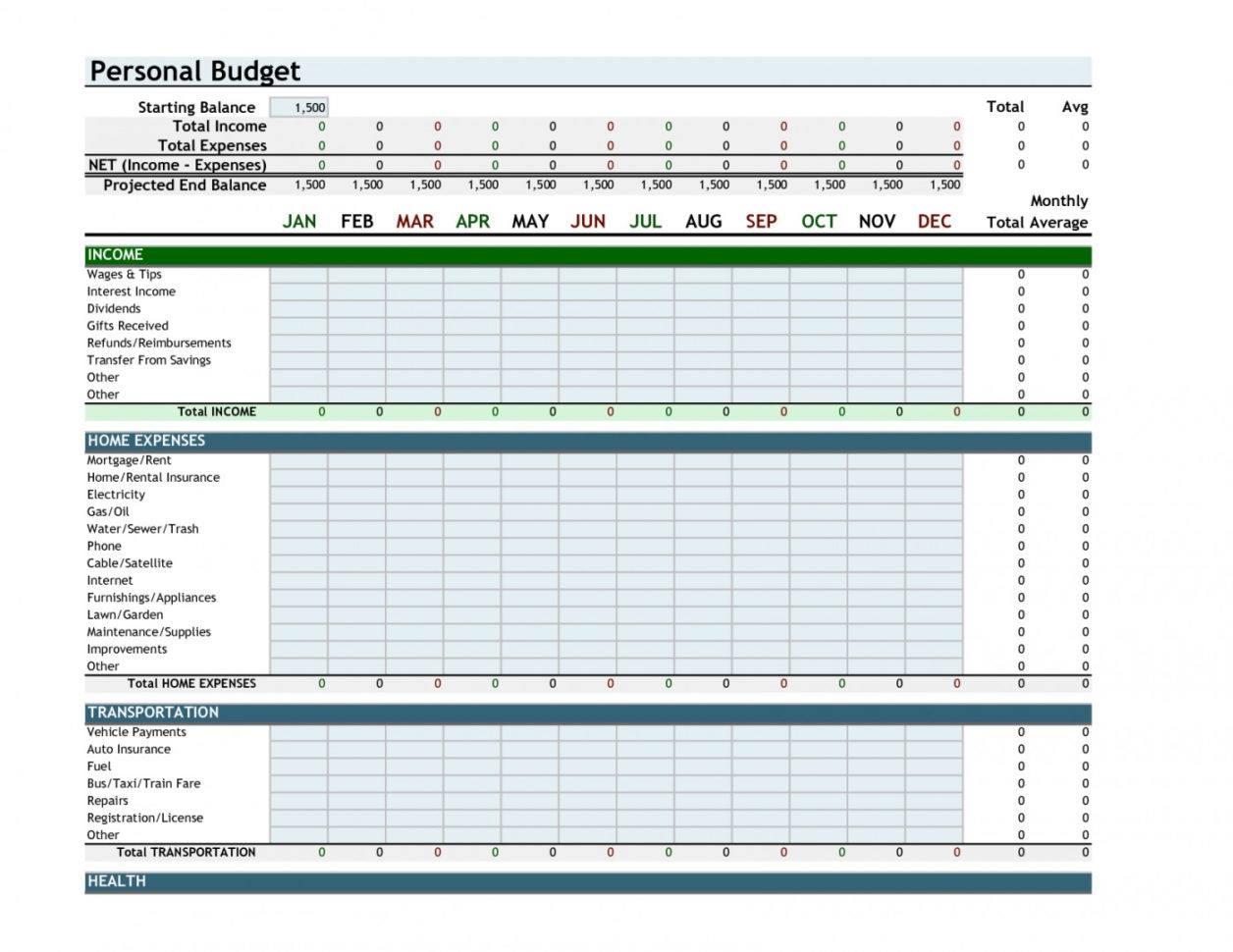

So now, one of them pays a friend to transport her to doctor's and dental appointments, grocery shopping, etc., and this was all worked out on a mileage basis, with amounts factored in for repairs, insurance and fees, etc.They do have a fair retirement "nest egg" built up though, that they'd like to avoid drawing down from for as long as possible.They're going to either buy a smaller home or retire to a senior community - they haven't decided which yet though. However, the refi wasn't as much as they wanted, so they've had yard sales and also sold some recreational vehicles and assets of their youth - they're semi-retired - and they also sold one of their two cars.They have recently refinanced their home to take advantage of low interest rates and to do a remodel, driveway repaving and fix the roof.They own their own home and rent out a room to also supplement their income the tenant also does housework and cooking, etc.They own a small business they report on Schedule C of Form 1040.They have other investments and are pretty thrifty.They also have a supplemental trust left to them.This couple / family receives at least 1 paycheck, more probably at least 2.(Note: if you're SHORT per your Budget, you need to spend less, get a loan and/or to make more money.).Cash On Hand: OVER (SHORT),Ending Balance.ADD: Withdrawals from Savings (except new home).Cash On Hand: OVER (SHORT), Beginning Balance.

BUDGET WORKBOOK HEALTHCARE REGISTRATION

C - Licenses, Fees, Registration Expenses Donations: Church and Other Tax-deductible.Education & Training Expense Unreimbursed.Career/Professional Library +/or Software, Aids.Other Professnl Fees, Dues, Subscrptns, Mmbrshps.Chronic Conditions Counseling, w/ Transport.Groceries, Rx & Comestibles (non-deductible).Sys: Macs, Phone, TV, Printer Ink & Ppr.

0 kommentar(er)

0 kommentar(er)